Expecting the Unexpected: Every Financial Plan Needs an Emergency Fund!

Life is unpredictable, and an emergency fund can help prepare you for the worst that life throws at you.

Whether it’s unexpected medical bills, car repairs, or a sudden job loss, having an emergency fund can help you weather the storm and avoid financial hardship.

Creating an emergency fund is the very first step in financial planning. Here’s why you should have an emergency fund and the do’s and don’ts after you set up your fund.

Why should you have an emergency fund?

1. Avoid Debt

Without an emergency fund, you may be forced to rely on credit cards or loans to cover unexpected expenses. This can lead to high-interest debt and a cycle of financial stress.

Just yesterday I got a bill for $661.57 because my car got towed. Without my emergency fund, I would have had to take on credit card debt and pay the exorbitant interest rates of credit card companies.

Having an emergency fund allowed me to avoid taking on debt and stay in control of my finances.

Emergencies can happen at any time, and having an emergency fund can help you prepare for the unexpected. By building up your emergency fund, you’ll be better prepared for any challenges that come your way, and you’ll be able to face them with confidence.

2. Peace of Mind

Knowing that you have a safety net can give you peace of mind and reduce stress. You won’t have to worry as much about unexpected expenses or circumstances, and you can focus on other things knowing that you’re financially prepared for emergencies.

I primarily rely on my corporate finance job as my income source. A lot of companies have been layoff employees in the past couple of months, and I know that there is a significant chance of me being laid off as well.

I’m able to stay calm in today’s job market because I have an emergency fund of 1 year’s expenses saved up. If I were to ever get laid off, I’ll be able to maintain my current lifestyle for a year while I recruit for a new job.

Having an emergency fund has been extremely helpful for my mental health and my anxiety. I believe everyone should have an emergency fund to prepare for the worst-case scenarios in life.

How to Build an Emergency Fund?

You may be wondering, “How much should I save for my emergency fund?”

Generally, finance enthusiasts and experts recommend 3-6 months of expenses.

Start small when you first start building your emergency fund so you don’t get discouraged. First, save $1000 for your emergency fund. Only then should you raise your emergency fund goals.

Steps to determine how much you should save:

- Determine how much your monthly expenses are: fixed + variable expenses

- Multiply it by the number of months you may need to cover without income

- Create a high-yield savings account to store your emergency fund

- Make contributions to your emergency fund

- Re-evaluate your risk tolerance and financial situation every couple of months to determine if you want to contribute more to your emergency fund

I would recommend you consider your unique situation after saving ~3 months of expenses before you decide on whether or not you should put even more money towards your emergency fund.

Consider opening a high-yield savings account so you can keep up with inflation. Because your emergency fund should be liquid and easily accessible, it’s best to not invest it in stocks or real estate. You can prevent your money from depreciating by putting it in a high-yield savings account with no fees.

To make the process even easier, set up bi-weekly or monthly automatic transfers (between $5-$200, anything helps) so you can build the fund without you even noticing it!

Some things to consider include:

- Your risk tolerance

- The economy

- Your financial situation (any debt)

- Your plans for the future

For some people, it makes more sense to save $1,000 first and put the rest of their excess paycheck toward their high-interest debt rather than saving a whole year’s emergency fund.

An Example: My Emergency Fund

When I first started my emergency fund, I started out small. I set a goal of $1,000 and slowly worked my way up to 3 months of expenses ($2,400 x 3 = $7,200).

Now, I have around a year’s worth of funds saved for the following reasons:

- I’m very risk-averse and get anxious when I don’t have a large emergency fund

- The economy right now is very turbulent, so it’s very possible for me to be laid off

- I’m able to contribute more to my emergency fund because I don’t have debt that I need to be paying off

- I may want to switch jobs or start some big projects in the near future.

Having a whole year’s worth of emergency funds saved up may seem like overkill to some, but this is what I need to feel secure in my finance.

Your financial plan should cater to your specific lifestyle and situation, so think about the different factors listed above when you’re making decisions regarding your financial plan.

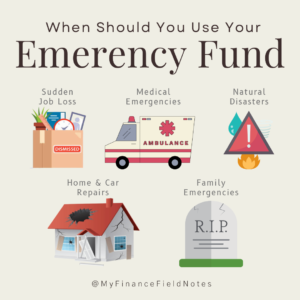

When Should You Use Your Emergency Fund?

An emergency fund is an important financial safety net that can provide you with the necessary funds to cover unexpected expenses. However, it’s important to know when to use your emergency fund and when it’s best to hold onto those funds.

Here are some examples of situations when it may be appropriate to use your emergency fund:

- Sudden Job Loss: If you lose your job unexpectedly, your emergency fund can provide you with a financial cushion while you search for a new job. This can help you cover your bills and living expenses until you find a new source of income.

- Medical Emergencies: Medical emergencies can be expensive, even if you have health insurance. Your emergency fund can help you cover unexpected medical expenses, such as emergency room visits or surgeries.

- Home or Car Repairs: Major home or car repairs can be expensive and unexpected. If you need to replace your furnace or repair your car after an accident, your emergency fund can help cover these expenses.

- Natural Disasters: Natural disasters, such as hurricanes or floods, can be devastating and expensive. Your emergency fund will help cover expenses related to evacuating or repairing your home after a disaster.

- Family Emergencies: If a family member has an emergency and needs financial support, your emergency fund can help you provide the necessary assistance.

An emergency fund can provide you with financial support during unexpected events, it’s not meant to be used for everyday expenses or non-emergencies. Use your emergency fund only for unexpected emergencies and replenish it as soon as possible after using it.

For any one-time expenses, you can plan for them by creating sinking funds.

When not to use your emergency fund?

On the other hand, here are a few examples of situations when you should avoid using your emergency fund:

- Non-Emergency Expenses: Your emergency fund is intended to be used for unexpected expenses, such as medical bills or car repairs. It’s important not to use your emergency fund for non-emergency expenses, such as a vacation or a new TV.

- Planned Expenses: Don’t use your emergency funds for a planned expense coming up, such as a home renovation or a child’s college tuition. Instead, plan ahead and save for these expenses by creating separate sinking funds.

- Everyday Expenses: Your emergency fund is not intended to be used for everyday expenses, such as groceries or gas. If you find yourself needing to dip into your emergency fund for these types of expenses, it may be a sign that you need to adjust your budget and spending habits.

- Investments: It’s important to keep your emergency fund in a liquid and easily accessible account, such as a savings account. You should avoid investing your emergency fund in stocks, bonds, or other investments that may not be easily accessible in case of an emergency.

In general, you should only use your emergency fund for true emergencies that are unexpected and urgent. Use your emergency fund wisely and replenish it as soon as possible after using it. This will ensure that you have a safety net in place for any unexpected expenses that may arise in the future.

Read this article to learn how to create sinking funds for your budget so you can avoid dipping into your emergency funds!